The Central Bank of Nigeria has taken the decision to revoke the license of Heritage Bank with immediate effect.

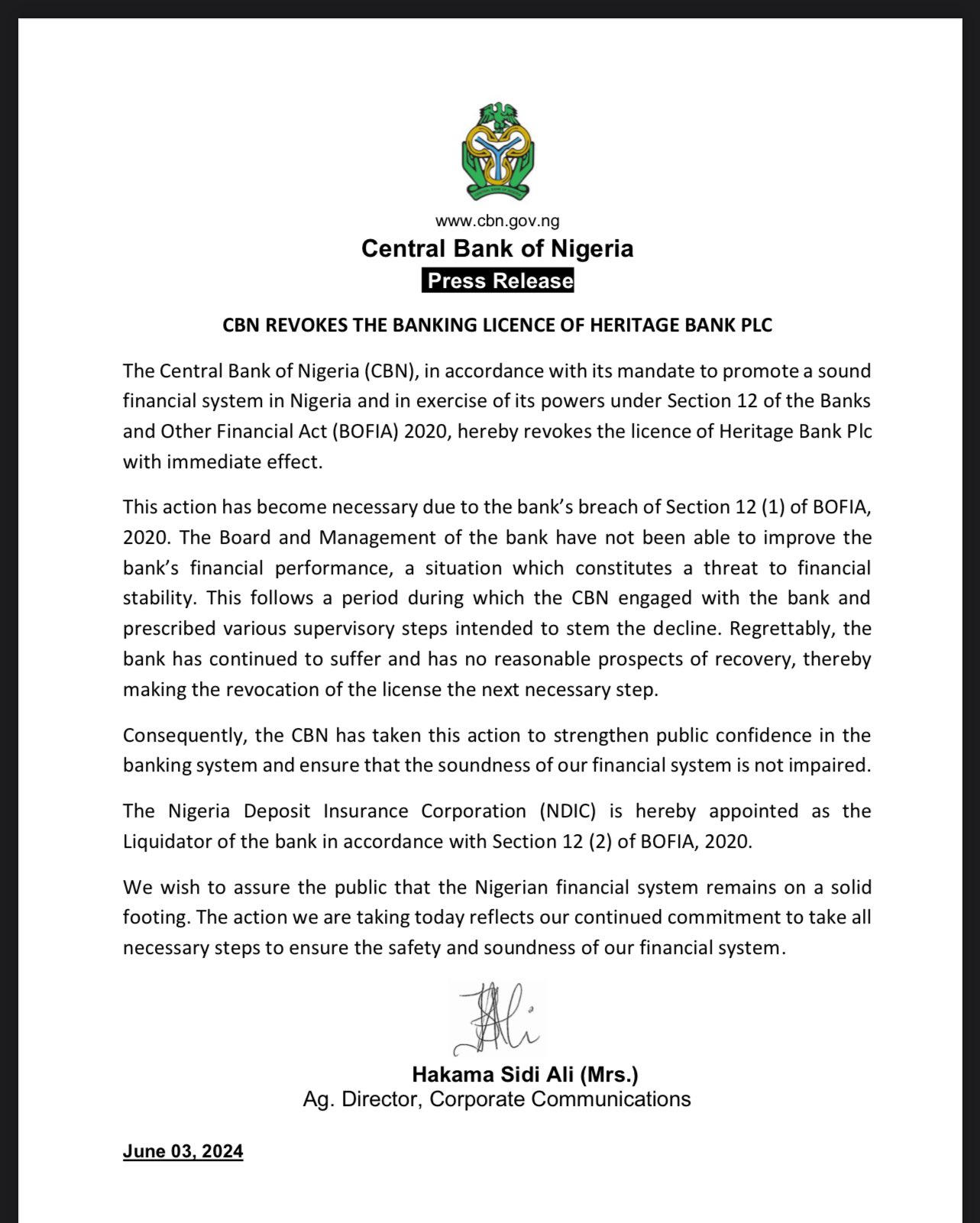

In a significant move to safeguard the financial system, the Central Bank of Nigeria (CBN) has revoked the banking license of Heritage Bank Plc. This decision, announced today, was made in accordance with CBN’s mandate to promote a sound financial system in Nigeria and under the powers granted by Section 12 of the Banks and Other Financial Act (BOFIA) 2020.

The CBN stated that the revocation was necessary due to Heritage Bank’s breach of Section 12 (1) of BOFIA 2020. Despite efforts by the Board and Management of the bank, Heritage Bank has been unable to improve its financial performance, posing a threat to financial stability. Over a period of engagement, the CBN implemented various supervisory steps to address the issues, but the bank continued to suffer with no reasonable prospects of recovery.

“As a result, the revocation of the license was deemed the next necessary step to protect the banking system and maintain public confidence,” the statement from CBN explained.

You may also like to read: CBN slashes Customs FX duty rate by 5.3% as naira stabilizes

The Nigeria Deposit Insurance Corporation (NDIC) has been appointed as the Liquidator of Heritage Bank in line with Section 12 (2) of BOFIA 2020. The CBN assures the public that the Nigerian financial system remains robust and that this action reflects their ongoing commitment to ensuring the safety and soundness of the financial system.

**Hakama Sidi Ali (Mrs.)**

Ag. Director, Corporate Communications